UK registrations hit over 1 Million cars since the start of 2024

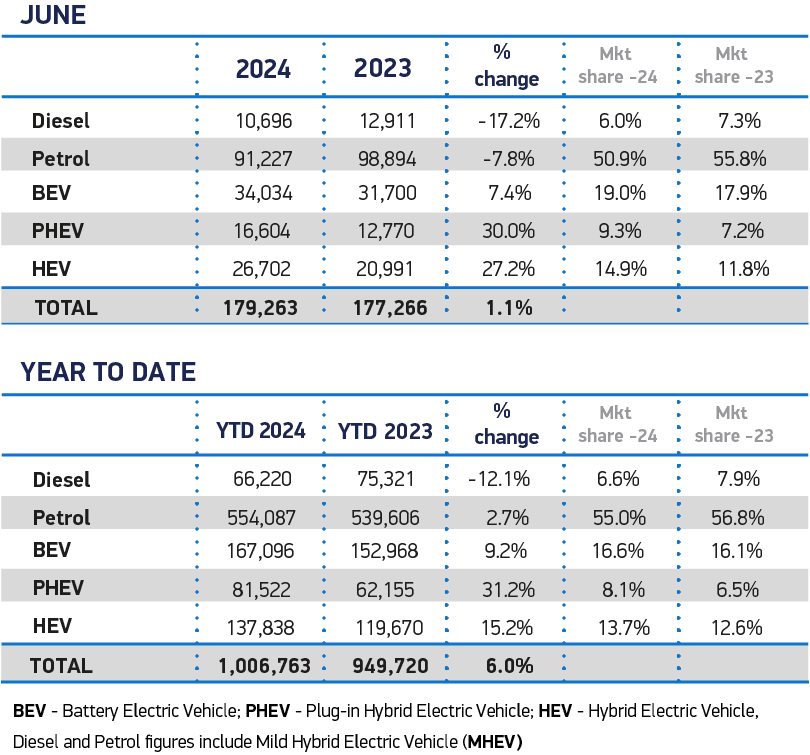

After the recent release of the SMMT figures for June, the UK new car registration market's trend for the first half of 2024 is quite evident. Despite reports pointing out a decline in retail sales, both monthly and year-to-date registrations show growth of 1.1% and 6.0% respectively compared to the previous year.

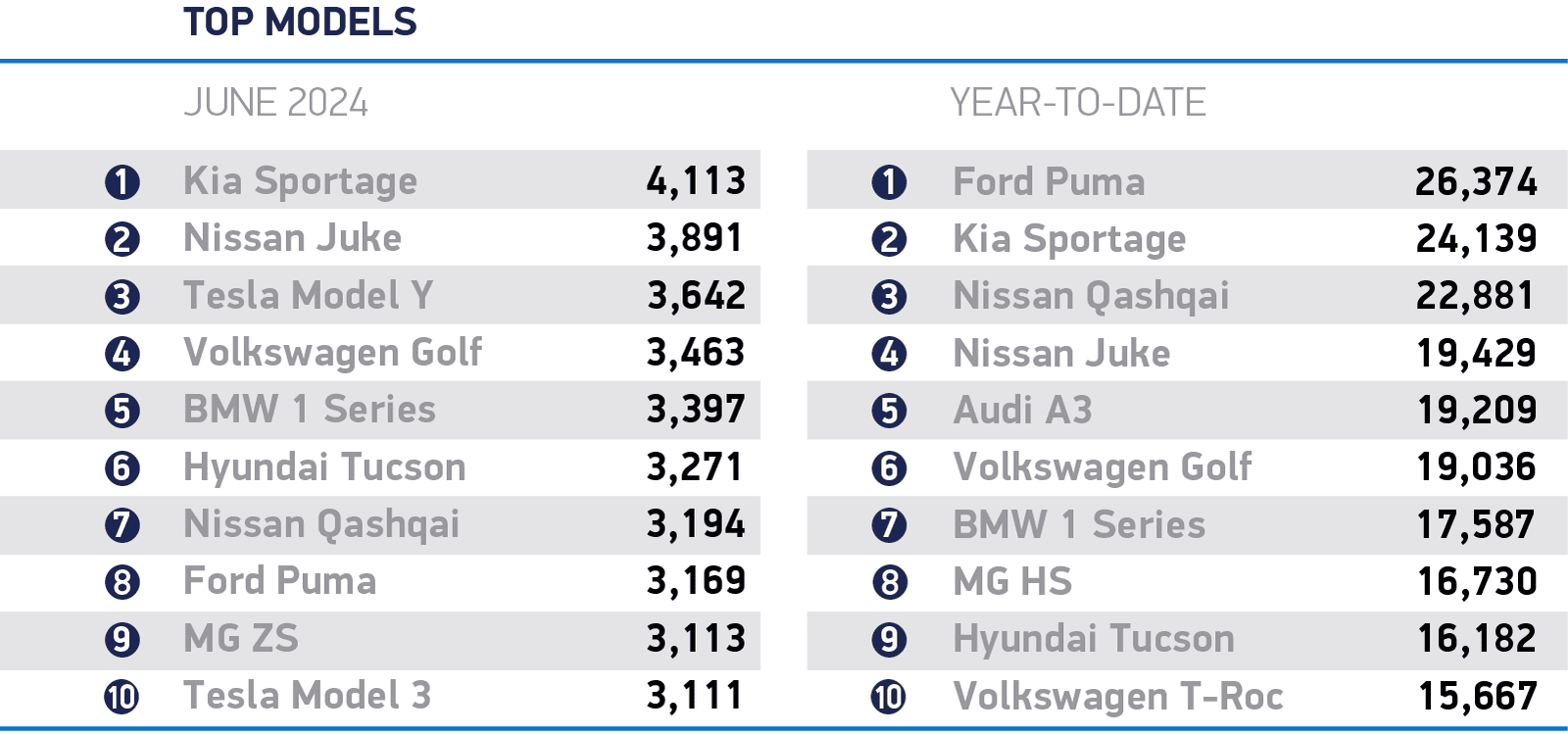

If this growth rate persists, the year-end projections suggest over 2 million cars could be registered by the end of 2024. The market is witnessing a rise in electric vehicles and Plug-in hybrids, constituting nearly 30% of new cars in June and almost 25% of the total registrations this year. Notably, Tesla maintains the lead in registrations, but other brands like Volkswagen are swiftly closing the gap. With traditional automakers expanding their EV offerings and EVs becoming available in all market segments, Tesla's current 22% new registration share is expected to diminish as the market transforms.

In response to the overall figures SMMT chief executive Mike Hawes says “The year’s midpoint sees the new car market in its best state since 2021 – but this belies the bigger challenge ahead. The private consumer market continues to shrink against a difficult economic backdrop, but with the right policies in place, the next government can re-energise the market and deliver a faster, fairer zero emission transition. All parties are agreed on the need to cut carbon and replacing older fossil fuel based technologies with new electrified powertrains is the essential step to achieving that goal.”

From within the industry Ian Plumber, Auto Trader commercial director says “June marked the 8th consecutive month of decline in retail sales - quite a contrast to the months of huge demand we've been tracking in the used car market. With average new car prices rising almost 40% over the last five years, it’s clear cost is the culprit. Manufacturers are responding with discounts but they're failing to keep pace, which is forcing many buyers to opt for a used alternative. Whoever forms the next government needs to address electric car affordability and provide long term stability for the market, securing the future of the salary sacrifice and Benefit in Kind schemes is essential as these drive the majority of new electric car uptake and it will be very difficult to scale without these. The market for used EVs is much stronger, which shows drivers are willing to go electric when the price is right”

However, looking at the bigger picture, Fleet sales of Battery Electric Vehicles (BEV) are on the rise. Although new registrations for these vehicles among private buyers are slower, overall sales are increasing. This growth can be attributed to the surge in Salary Sacrifice schemes that are particularly favorable for electric vehicles. These schemes are attracting customers who would typically have purchased a vehicle as consumers and are now shifting them to become Fleet users.

Ian Plumber points out that pricing and discounts are steering customers towards considering used alternatives. The expanding presence of electric vehicles that are up to 5 years old in the second-hand market offers customers a wide selection to transition to electric options. There are nearly ten times more used electric vehicles up to 5 years old compared to those introduced in the UK after that period. With this abundance of choices, buyers who previously had to purchase a new EV to enjoy the benefits can now opt for a relatively new used vehicle and still experience improvements in range and features.