Battery electric vehicle uptake outpaces overall market, up 18.8%, but remains behind mandated transition trajectory.

Battery electric vehicle uptake outpaces overall market, up 18.8%, but remains behind mandated transition trajectory.

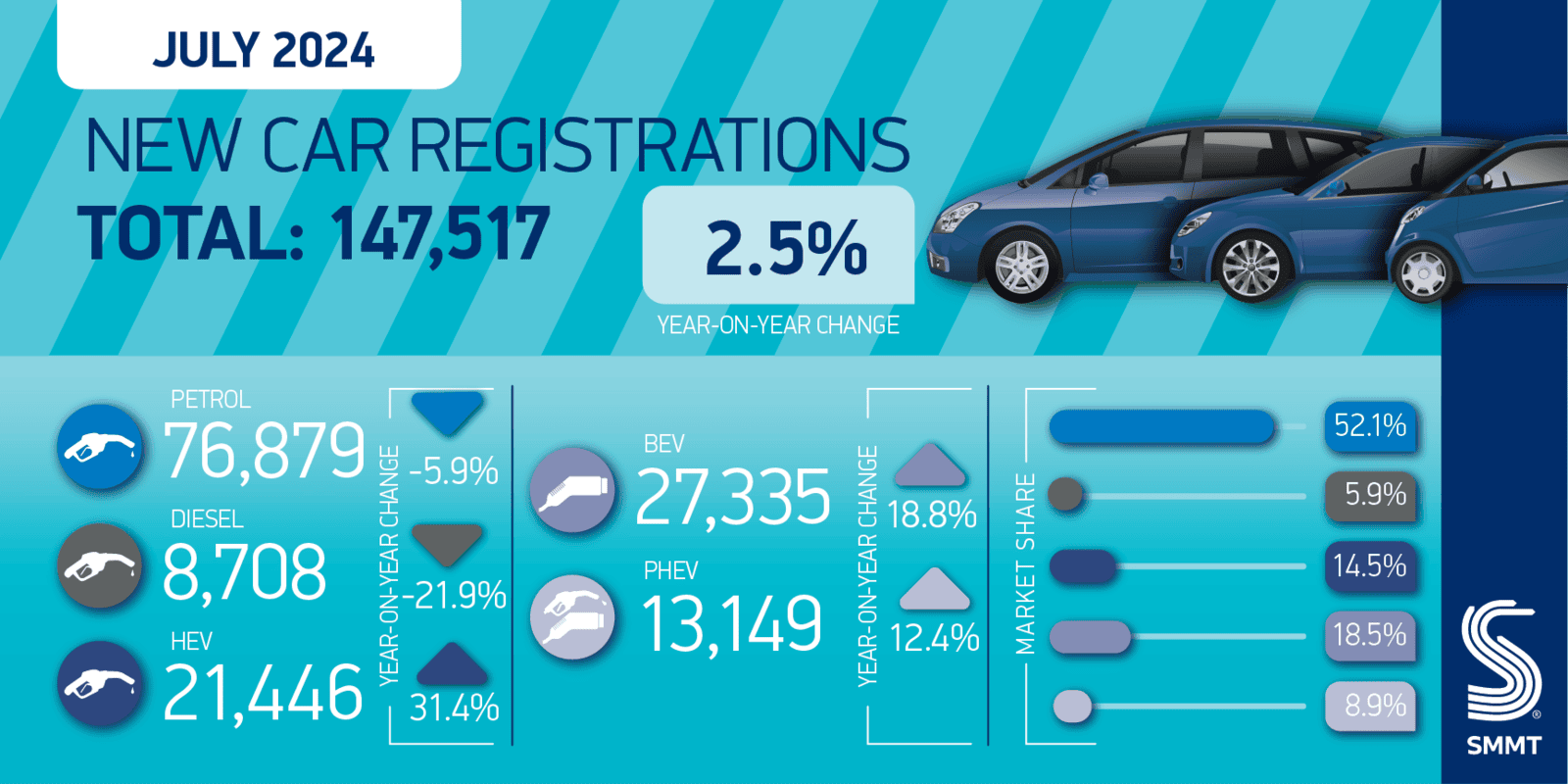

With new car registrations increasing by 2.5% in July 2024, the UK car market is continuing its two-year ongoing growth as s steady rebound from the disruptions caused by the pandemic. July alone saw 147,517 new cars hitting the road, making it the best performance since the post-lockdown surge of 2020.

A significant amount of this growth is the fleet sector, which recorded a 13.0% increase in registrations, securing a dominant 62.0% market share. In contrast, private demand has been declining, falling by 11.1% to account for only 36.2% of deliveries in the month. One interesting factor contributing to this decline is the rising popularity of salary sacrifice schemes.

Electrified vehicles (EVs) are making significant inroads in the UK market, outpacing overall market growth. In July, 42.0% of new car registrations were for electrified vehicles. Hybrid electric vehicles (HEVs) saw a notable 31.4% increase, capturing 14.5% of the market, while plug-in hybrids (PHEVs) grew by 12.4%, representing 8.9% of registrations. However, the real standout is battery electric vehicles (BEVs), which surged by 18.8%, capturing an 18.5% market share. Despite a 3% drop in the private share of the BEV market compared to last year, the volume of private BEV registrations still increased.

The UK government requires zero-emission vehicles to comprise at least 22% of each brand’s new car registrations. This ambitious target necessitates a significant acceleration in the pace of EV adoption. However, industry forecasts suggest that meeting this target may be challenging under current market conditions. The overall market growth forecast for 2024 has been revised downwards, with expectations of 1.968 million new car registrations by year-end. Similarly, the anticipated BEV market share has been adjusted downwards to 18.5% from the previously expected 19.8%, however this still represents a further 364,000 electric vehicles forecast to be registered by the end of 2024. These vehicles will then feed into the used car market in the coming 3-4 years as the fleets change in the future.

These trends underscore the dynamic shift towards electrified vehicles in the UK, driven by consumer preferences and regulatory pressures. As more consumers and businesses embrace EVs, the market is poised for continued evolution, albeit with some challenges along the way.

Salary sacrifice schemes are playing a pivotal role in this transformation. These schemes allow employees to lease electric vehicles through pre-tax salary deductions, making EVs more accessible and financially appealing. The financial incentives are compelling, with significant tax benefits, including lower Benefit-in-Kind (BIK) rates and National Insurance savings, making electric vehicles a cost-effective choice for employees. Additionally, employers benefit by managing costs effectively and supporting their sustainability goals, aligning with broader environmental initiatives and enhancing corporate social responsibility profiles.

Many salary sacrifice schemes now include essential services like maintenance, insurance, and home charger installation. These inclusions simplify the transition to electric vehicles and provide additional value to employees. For instance, Octopus Electric Vehicles includes a home charger installation in their package, enhancing the overall appeal of their salary sacrifice scheme. Similarly, The Electric Car Scheme offers straightforward options for home charging solutions, addressing one of the common concerns about EV ownership—convenient and accessible charging.